5 Best Alternatives to Atom Finance

A comprehensive overview of the best investment research terminals available

Atom Finance is discontinuing its investment terminal for consumers as of March 1st, 2024.

For all the investors looking for a new home to track, research, and discover investments, here are the top 5 services available today.

1.) FinChat.io

FinChat is the complete research platform for fundamental investors. With FinChat, investors get advanced financial data, company specific KPIs, robust analytics, and a conversational AI Assistant custom-built for investing questions.

Between its remarkable breadth of data and its intuitive design, FinChat is easy-to-use while having everything a fundamental investor needs.

FinChat.io enables users to quickly access the numbers that move the needle of the business and comprehensive fundamental analysis tools to make data driven investment decisions.

Additionally, FinChat.io offers a wide range of customization options, allowing users to tailor the platform to their specific needs and preferences. This is a modern take on the Bloomberg Terminal at a fraction of the price.

Here's a quick overview of FinChat's best features:

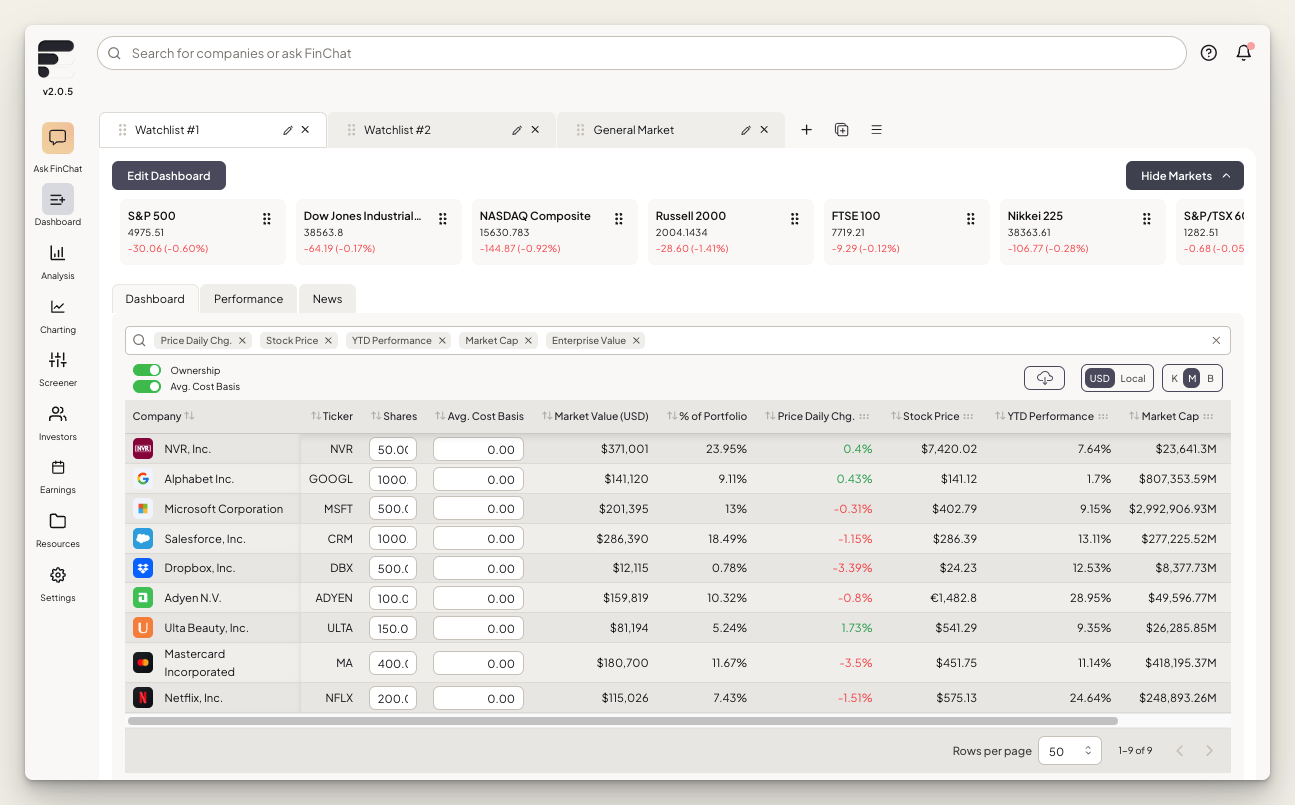

Customizable Dashboards

One of the most important things for investors to have is a robust dashboard. This allows investors to keep a better eye on their portfolios and track which stocks on their watchlist could be worth taking a deeper look at.

And FinChat's dashboard is best-in-class. With FinChat's Dashboard investors can:

- Get real-time prices on all the stocks in their portfolio.

- Select from more than 100 different metrics to sort by.

- Set up notifications for all their positions.

- Track and monitor general market news.

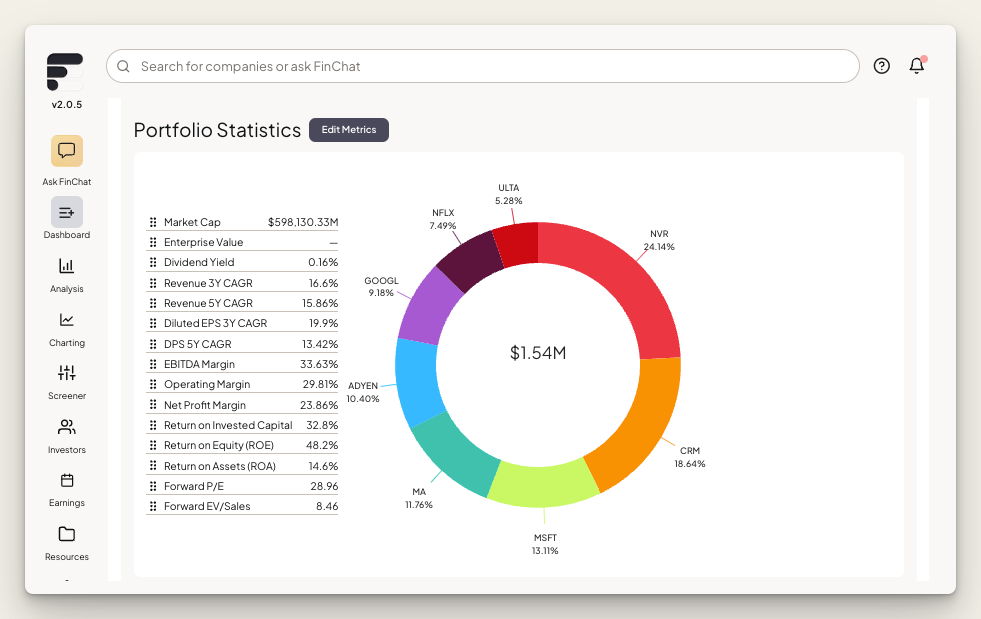

- Fill out their position sizes to see overall portfolio statistics.

This is the best solution for fundamental investors to track their portfolios.

Granular KPI Data

FinChat goes beyond the standard financial metrics and tracks the metrics that really matter for each company specifically.

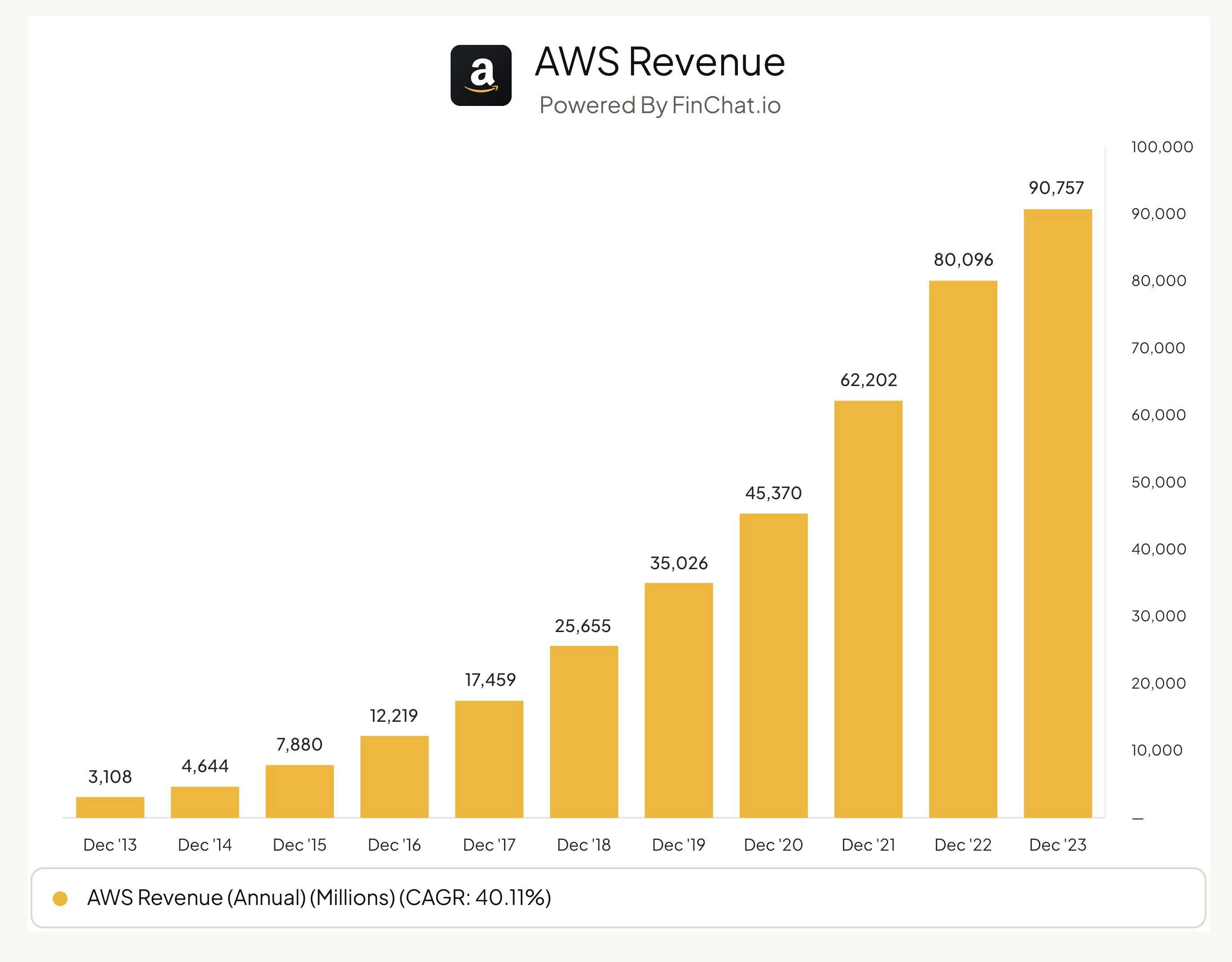

- Want to see Amazon's Cloud Revenue? They track it.

- Want to see Home Depot's store count? They've got it.

- Want to know how many Lithography machines ASML sold last quarter? Ya, they have that too.

FinChat tracks company-specific Segment & KPI data on more than 1,500 stocks. And the list continues to grow every day.

Conversational AI

Backed by its institutional-grade financial database, FinChat.io offers the most robust conversational AI for fundamental investors.

By simply clicking the gold "Ask FinChat" icon in the top-left corner of the platform, users can quickly receive comprehensive answers to any of their investing questions in an easy-to-understand response.

FinChat can save investors tons of time when looking for specific data or can be helpful for generating new ideas.

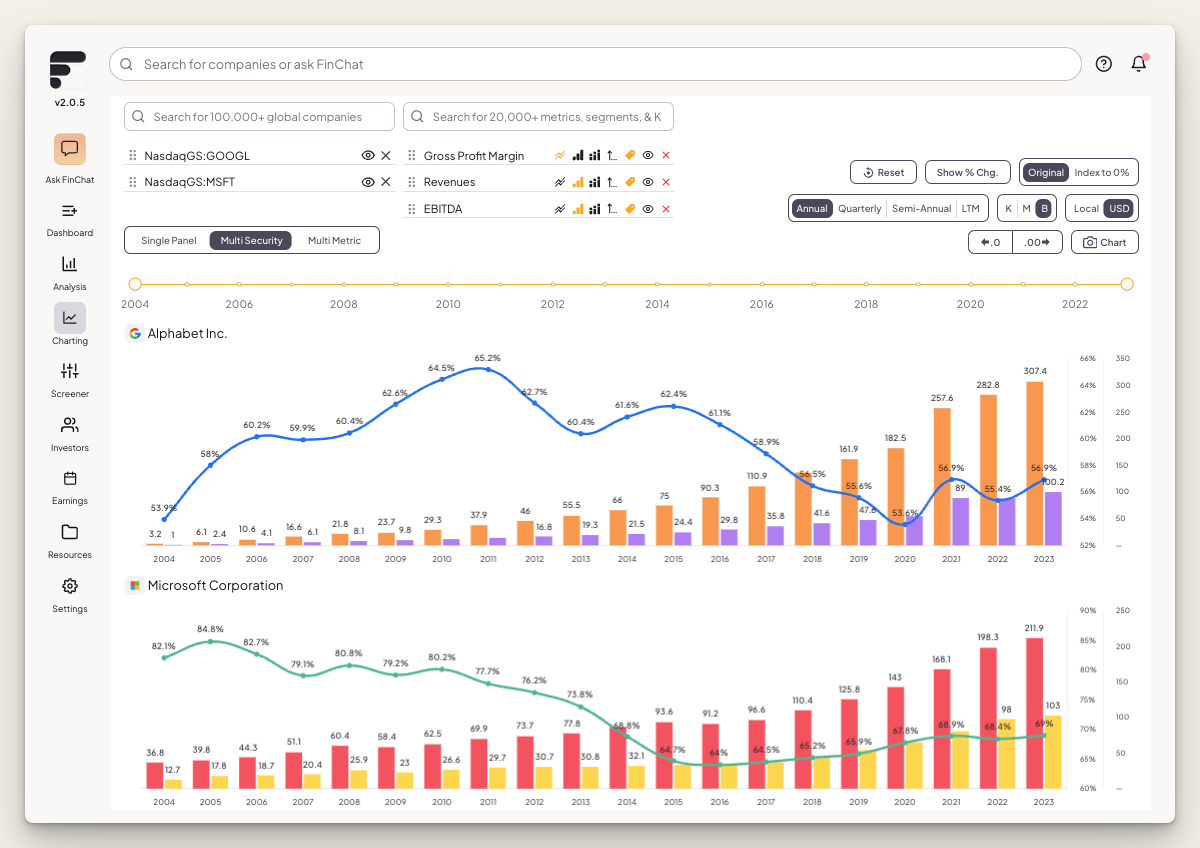

Data Visualizations & Charting

FinChat.io has a user-friendly, all-in-one charting interface that is easily accessible directly from the company homepage. The first graph will display 20+ year historical price, % change, and total return, and includes the option to add additional tickers and compare across companies.

Powered by FinChat's proprietary data, users can choose from any metric including from FinCHat's extensive list of Segments and KPI's.

Best part is, FinChat's charting is easy on the eye and great for sharing.

Summary:

FinChat is the #1 solution because it wins in the following categories:

✅ Dashboards

✅ Granular KPI data!

✅ User interface

✅ Data visualizations & charting

✅ Ease of use

✅ Conversational AI

✅ Transcripts

✅ Super Investor Tracking

✅ Free plan provides global coverage

Pricing:

FinChat has 3 pricing tiers

- Free: 5 years of financial data, 2 years of Segments & KPIs, 1 dashboard.

- FinChat Plus: $24/month (billed annually) or $29/month (billed monthly). 10 years of financial data, 5 years of Segments & KPIs, unlimited dashboards.

- FinChat Pro: $61/month (billed annually) or $79/month (billed monthly). 20 years of financial data, unlimited Segments & KPIs, unlimited AI prompts, Excel Add-in, & premium support.

For a limited time, you can also get 15% off any paid plan using code "FC15" at checkout.

To learn more, see the pricing page.

2.) Koyfin

Koyfin is a financial analytics platform that offers a wide range of tools for investors to gain insights into their investments. The platform provides advanced graphing, market dashboards, and various features for portfolio management and stock research.

Summary:

Here's where Koyfin scores well:

✅ Very customizable

✅ Advanced charting capabilities

✅ Covers stocks globally

Pricing:

Koyfin offers three pricing plans:

- Free: 2 watchlists, 2 screens, 2 chart templates, advanced graphing, and market dashboards.

- Plus: $39 per month. Offers 10 years of financials, unlimited watchlists, 10 metrics per watchlist, global market news, and full access to snapshots.

- Pro: $79 per month. Includes everything in the Plus plan, as well as unlimited custom formulas, US mutual fund data, mutual fund holdings, custom FA templates, and exclusive training webinars.

3) Tikr

TIKR is a financial data platform that provides access to comprehensive financial data for over 100,000 global stocks across 6 regions, 92 countries, and 136 exchanges. The platform caters to individual investors, professionals, and enthusiasts.

Summary:

Here's where Tikr scores well:

✅ Lower priced offerings

✅ Detailed Wall Street analyst estimates

✅ Portfolio holdings of top funds

Pricing:

Tikr offers three pricing plans:

- Free: Offers data for U.S. stocks, unlimited watchlists, 1 saved screen, top 40 funds' holdings, 5 years of financial history, 2 years of Wall Street analyst estimates, and 90 days of transcript history (U.S. only).

- Plus: Priced at $19.95 per month or $14.95 per month with an annual plan. Includes data for 100,000+ global stocks, 5 saved screens, 10,000+ funds' holdings, 10 years of financial charting, 3 years of Wall Street analyst estimates, and 3 years of global transcripts history.

- Pro: Priced at $39.95 per month or $29.95 per month with an annual plan. Offers all Plus features, unlimited saved screens, premium valuation metrics, 20 years of financial charting, detailed analyst estimates, management guidance, full global transcripts history, and priority support.

4) Yahoo Finance Plus

Yahoo Finance Plus is a comprehensive financial research platform that offers advanced tools and insights to help investors navigate the markets. The platform caters to individual investors.

Summary:

Here's where Yahoo Finance Plus scores well:

✅ Includes research reports from Morningstar

✅ Export capabilities for historical financials

✅ Enhanced Charting

Pricing:

Yahoo Finance Plus offers two pricing plans:

- Lite: Priced at $20.83 per month, billed annually. Includes daily trade ideas based on your interests, fair value analysis for stocks, advanced portfolio performance analysis tools, Yahoo Finance community insights, enhanced alerts, live chat support on desktop, ad-free Yahoo experience, and 24/7 account support.

- Essential (Most Popular): Priced at $29.16 per month, billed annually. In addition to the features in the Lite plan, this plan includes research reports from Morningstar & Argus, enhanced charting with auto pattern recognition, historical financials & statistics with CSV export, unique company insights on leading indicators, and Market Digest newsletter.

5) TradingView

TradingView is a popular charting and social platform for traders, offering an extensive range of features, tools, and plans to cater to different levels of ambition. With powerful charting tools, real-time data, and a strong community, TradingView has become a go-to resource for traders of all experience levels.

Summary:

Here's where TradingView scores well:

✅ Great for technical analysis!

✅ Real-time data and multiple market coverage

✅ Has both mobile and desktop apps

✅ Helpful charting tools and indicators

Pricing:

TradingView offers three pricing plans:

- Free: Basic features

- Essential: $12.95/month (annually) or $14.95/month (monthly)

- Plus: $24.95/month (annually) or $29.95/month (monthly)

- Premium: $49.95/month (annually) or $59.95/month (monthly)